All You Need to Know About VAT/PAN Bills In Nepal

When it comes to navigating the financial landscape of Nepal, understanding the intricacies of VAT (Value Added Tax) and PAN (Permanent Account Number) bills is essential. Whether you’re a business owner, a distributor, or a consumer, these bills play a crucial role in transactions. Let’s delve into the details of each type of bill and what you need to know about them.

Estimate Bill

The estimate bill is a document often utilized in credit transactions where payment hasn’t been made yet. Typically, manufacturers or distributors provide items to retailers on credit, and this bill serves as a record of the transaction. It may feature discounts and is usually a generic form readily available in the market. However, it may not necessarily bear the name of the specific firm involved.

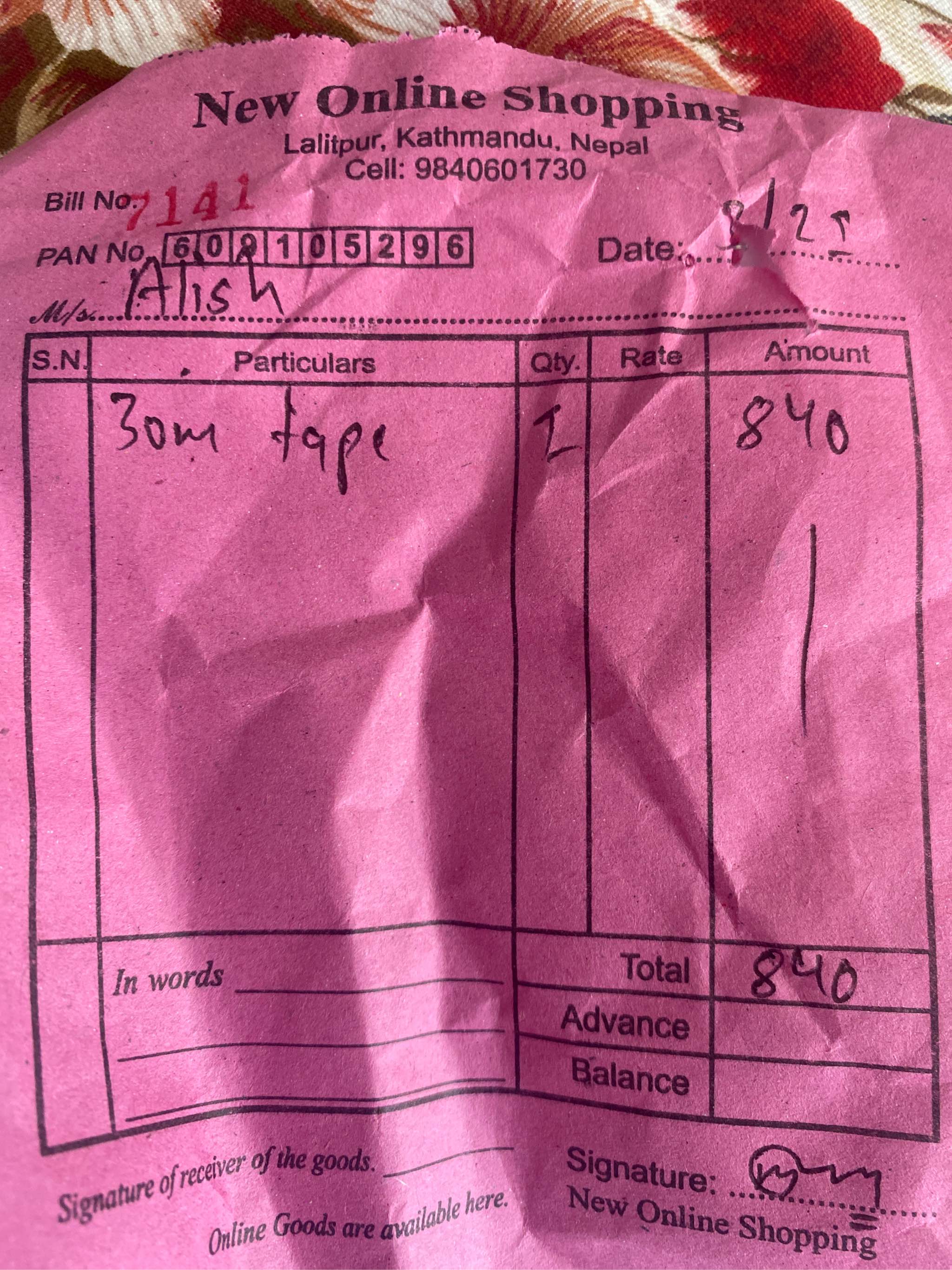

PAN Bill

PAN bills are issued by enterprises, companies, or businesses that do not need to be registered for VAT but must have a PAN from IRD Nepal. This bill includes essential details such as the PAN number, date, name, address, etc. There are also provisions to include the buyer’s PAN if necessary.

VAT Bill

The VAT bill is a more comprehensive document, featuring the firm’s PAN number prominently and labeled as a “Tax Invoice.” It includes details such as the buyer’s name, address, and VAT/PAN number. Additionally, there’s space for discounts and a breakdown of VATable/taxable amounts, with VAT calculated at 13%. It’s imperative for the seller to sign the bill, and there may also be provisions for the buyer’s signature. The VAT bill typically generates three copies—one for the customer, one for the auditor, and one for the seller’s reference. Some businesses, especially those operating online, may generate an additional copy for delivery agents.

Abbreviated Bill

Similar to the estimate bill, the abbreviated bill does not allow for VAT refunds or depreciation claims with IRD (Inland Revenue Department). It serves as a concise record of the transaction but lacks the comprehensive details required for VAT-related processes.

Understanding the nuances of these bills is crucial for businesses to ensure compliance with tax regulations and maintain accurate financial records. Whether you’re issuing or receiving these bills, being informed about their purpose and content can streamline financial processes and foster transparency in transactions within the Nepalese business landscape.